Pearl River

Trust Deposit

Pearl River Trust Deposit is a

Managed Forex Trading Account

IMPORTANT INFORMATION: This Fact Sheet is for information purposes only. The information is not intended and must not be construed to be an offer to sell any investment in the Pearl River Trust which is available exclusively as a Trust Deposit in an eligible trust offered by Marathon Corporation. The Trustee is the only eligible subscriber of the Pearl River Trust Managed Forex Trading Account. Please refer to the Disclaimer at the end of this Fact Sheet for further important information.

Introduction

Pearl River Trust Deposit is a Managed Forex Trading Account

Performance

This track record is an actual historical record showing returns after fees, normalized for an initial investment of one million US dollars

Key Statistics

| Target Monthly Return | +4% to +5% net |

| Target Annual Return | +4% to +5% net |

| Return since Inception on 10th Nov 2020 | +186.7% net |

| Length of Track Record | 21 months |

| Maximum Drawdown | -10.6% |

| Average Month Return | +5.2% net |

| Best Monthly Return | +12.4% net |

| Worst Monthly Return | -10.6% |

| 2021 Return | +65.1% net |

| 2022 Return (to date) | +49.3% net |

| Annualised Return Since Inception | +84.5% net |

| Recovery Time | Two months |

| Number of Negative Months | One month |

| Number of Positive Months | 20 months |

| Length of Track Record | 21 months |

| Structure | Trust |

Data as at 31 July 2022 based on net investment

Manager Strategy

Trades take place usually several times a day but during quiet times there could be a pause of a few days between trades.

Why it works

The strategy has performed remarkably well as the competitive pressures between the major market participants (banks) who earn money by pushing the markets in either direction without any underlying reason or a fundamental shift in the demand/supply dynamic. Therefore, the markets will be continuously in flux up and down for periods of time. It is those smaller movements in either direction that the strategy seeks to take advantage of in a small way, but on a regular basis, accumulating funds over time.

Deposit Terms

| Term | Description |

|---|---|

| Sponsor | Bird Rock Limited, a company incorporated in Hong Kong |

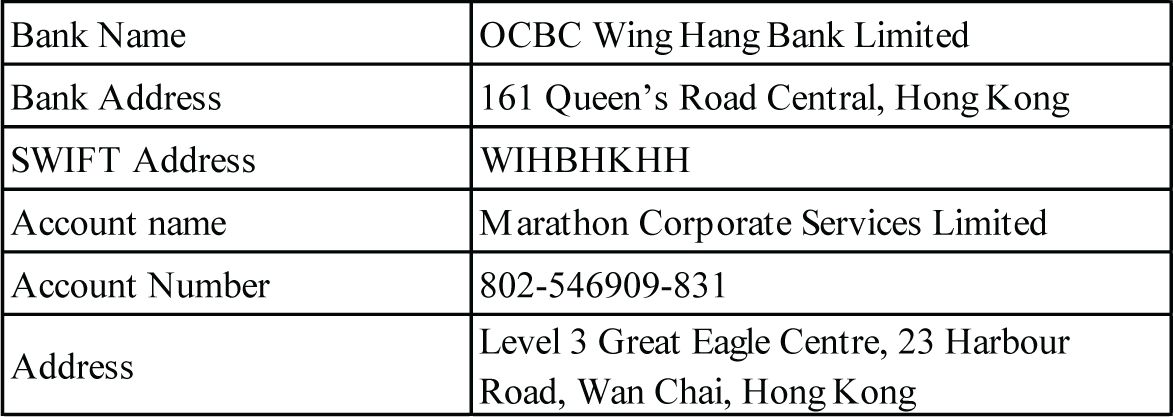

| Trustee | Marathon Corporate Services Limited, a licensed Trust and Company Services Provider (“TCSP”) registered in Hong Kong |

| Manager | Apogee Partners Limited, a Hong Kong Securities and Futures Commission licensed Type 9 Asset Manager |

| Reporting | Performance will be calculated monthly as of the close of business on the last business day of that month by the Trustee administering the Pearl River Trust. Account statements will be provided online monthly by the Trustee |

| Purchase Frequency | Purchases my be made monthly. Cleared funds should be received two working days prior to month-end |

| Subscription Fees | A fee of between 0% and 5% of the deposit amount to be agreed between the Agent and Member |

| Redemption | There is no lock-up period. Redemptions are available monthly with 14 days prior notice. The Manager may also suspend redemptions for market or liquidity reasons, which is in the sole discretion of the Manager and which may adversely impact returns |

| Performance Fee | 50% of the profits generated in the month subject to a high-water mark, calculated monthly and payable monthly |

| Operating Expenses | Pearl River Trust pays all operating expenses including but not limited to brokerage fees, legal fees, audit fees, transfer fees, bank charges, reporting and compliance fees |

| Minimum Subscription | Initial USD 20,000, thereafter USD 20,000 increments. Subscriptions may be made monthly |

| Leverage | Variable based upon market risk model |

| KYC / AML | Standard KYC and AML requirements apply |

Deposit Terms

Apogee Partners Limited is a Hong Kong incorporated Type 9 Asset Manager regulated by the Hong Kong Securities and Futures Commission. Team members include:

Ken Chad:

Chief Executive Officer of Apogee Partners Limited and a Responsible Officer as well as the Manager In Charge. He has over 30 years’ international business experience which includes financial services, corporate advisory and asset management

Partner with over 30 years’ experience as an

entrepreneur and business builder in Hong

Kong and China. Peter is responsible for

corporate strategy and business development

Risk Disclosure

This document does NOT disclose all the associated risks or other important aspects of the Trust Deposit, and it should NOT be considered as investment advice or recommendation for the provision of any service or investment in any financial instrument.

The Member should NOT carry out any transaction in any financial instruments unless fully aware of the nature, the risks involved and the extent of exposure in the risks. In case of uncertainty as to the meaning of any of the warnings described below, the Member must seek independent legal or financial advice before making any investment decision.

The Member should also be aware that:

The value of any investment in financial instruments may fluctuate downwards or upwards, and the investment may diminish to the extent of becoming worthless;

Previous returns do not constitute an indication of a possible future return;

Trading in Financial Instruments may entail tax and/or any other duty or financial charges; and Changes in the exchange rates, may negatively affect the value, price and/or performance of the Financial Instruments traded in a currency other than the Member’s base currency.

Market risk

Is the risk that the value of an investment will decrease due to the change in value of assets due to market factors such as the underlying exchange rates, political developments, and economic shifts. In case of a negative fluctuation in prices, the Member runs the risk of losing part or all of his invested capital.

Systemic risk

Is the risk of collapse of the entire market or the entire financial system. It refers to the risks imposed by interdependencies in a system or market, where the failure of a single entity or cluster of entities can cause a cascading negative effect, which could potentially bring down the entire system or market.

Technical risk

Faults in electronic equipment used to perform trading and investment operations may lead to unexpected and unpredictable results and therefore to losses on the Member’s operations in the international exchange market. At the carrying out of transactions via an electronic trading system, the Member runs the risk related to possible faults in the system, including equipment and software failures. The Pearl River Trust uses several different counterparties and redundant technical infrastructures to diversify this risk.

Operational risk

Operational risk is the risk of business operations failing due to human error. Operational risk will change from industry to industry and is an important consideration to make when looking at potential investment decisions. Industries with lower human interaction are likely to have lower operational risk.

Country risk

Is the risk that an investment’s returns could suffer because of political changes or instability in a country. Instability affecting investment returns could stem from a change in government, legislative bodies, other foreign policymakers, or military control.

Interest rate risk

Is the risk that an investment’s value may change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape of the yield curve, or in any other interest rate relationship.

Legal and regulatory risk

A change in laws or regulations made by the government or a regulatory body may increase the costs of operating a business, reduce the attractiveness of an investment and/or change the competitive landscape and by such materially alter the overall profit potential of the investment. This risk is unpredictable and may vary depending on the market for the underlying assets.

Risk of loss of invested funds.

It is possible for adverse market movements to result in the loss of the account balance in full.

No guarantee of profit.

There are no guarantees of profit nor of avoiding losses when investing in this Trust Deposit. Neither the Pearl River Trust nor its representatives intend to provide, or can they actually provide such guarantees. The Member has been alerted by means of this Statement that risks are inherent to investing in this Trust Deposit and that the Member must be financially able to bear such risks and withstand any losses incurred.

Disclaimer

This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. All persons and entities reading this information do so on their own initiative and are responsible for compliance with applicable local laws and regulations. This document is not directed to any person in any jurisdiction where the publication or availability of this information is prohibited, by reason of that person’s nationality, residence or otherwise. Persons under these restrictions must not continue reading this information.

Investment in the Pearl River Trust Managed Account Trust Deposits are available only to the Trustee of eligible trusts offered by Marathon Corporate Services Limited. Settlors’ or Beneficiaries of the Trusts should consider whether the Trust Deposit would be complementary to the investment objectives and strategies of their trusts when considering directing or asking investment advisors to direct the Trustee to make placements. The Trustee may rely on the advice of an investment manager in making any placement if directed. Settlors’ beneficiaries should seek professional and legal advice when considering such placements.

This investment carries exposure to substantial risk. You should refer to the risk disclosure statement above for details, including risk factors. It is possible that the entire value of your investment could be lost.

Any summaries of the strategies and terms of the Trust Deposit in this presentation are historic in nature and interested Settlors and Beneficiaries are cautioned that historical returns do not guarantee future results. In addition, this fact sheet contains important information concerning risks and other material aspects of the Managed Accounts and must be read carefully before a decision to direct a placement is made. Although the information in this presentation has been obtained from and is based upon sources that the Trustee believes to be reliable, no representation or warranty, express or implied, is made as to the accuracy or completeness of that information. The contents of these statements and this Fact Sheet have not been reviewed by any regulatory authority