ABS SECURED DEFI TRUST

A TRUST INCOME PRODUCT by ABS

The Capital Backing You Can Trust

About Us

ABS is an experienced asset management company that mainly provides convenient services to ABS investors.

The ABS team combines technical expertise in this emerging asset class and experience in launching investment vehicles for a variety of market participants.

Additionally, the ABS team is experienced in traditional asset management and an extensive background in building, launching and scaling financial products through digital assets.

ABS combines old and new economy. Created a new asset support plan for 2022,

Use 1 : 1 asset of the same value to help customers as capital backing.

ABS wants to create a hassle-free investment plan through this new economy system.

Create a safe and secure investment mentality for users to not worry about the risk of losing their investment capital.

4 Major Sectors of ABS

Invest through ABS and earn monthly income.

From

- Old Economy – Real Estate

- New Economy – Blockchain

Inject assets in ABS Secured Defi Trust (through Trustee) as Capital Backing. This allows investors to have the flexibilities at the end of each contract.

ABS uses a trust tool to create investment protection for all users.

ABS merging the old and new economy Use bank/market valued assets to provide investors 1 : 1 as asset-backed on all investments.

Why ABS?

Investors (through Trustee) invest in ABS, at the same time receive an asset-backed in full ownership OR fractional ownership as Capital Backing.

How Does ABS Protect Investors?

-

Assuming the investor invests 100,000 USDT.

-

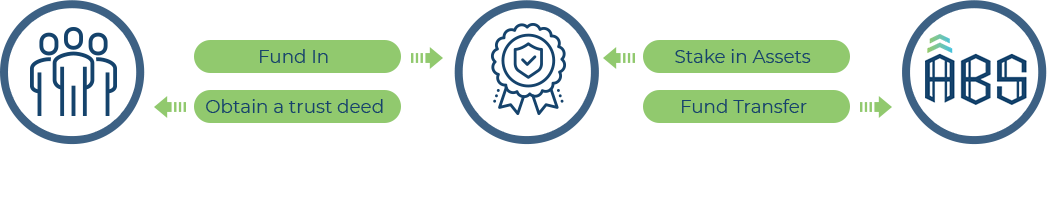

This 100,000 USDT will go into the trust company.

-

The trust company will link the investment to an asset or a fractional interest in an asset or a pool of assets, which equals to the investment value. This will be recorded in a trust deposit certificate issued by ABS Secured Defi Trust.

-

The trust company will transfer the investment amount to ABS to create profits.

HOW DOES TRUST PROTECT THE

INVESTORS’ INTERESTS?

A trustee serves as a neutral and an

independent entity, carrying out its duties and powers as authorized under the trust deed agreed upon by the parties.

The property will be assigned to the trust, and at the conclusion of the contract, the Trustee will execute and distribute the income of the trust based on the investors’ preference.

HOW IT WORKS (Example):

An investor invests 10,000 USDT, and this 10,000 USDT will go into the trust institution.

The trust institution will resettle the investment amount/trust fund by investing into another trust known as ABS Secured DeFi Trust, for the purpose of generating profits.

The trust institution will link the investment amount to a real estate which value shall equal to the investment amount. However, the investor has no rights to use the property nor be entitled to any benefits arising from the property during the fund period.

If at the expiry of the fund period, the investor selects the real estate, the Trustee will either (i) transfer the Property to the investor or (ii) in the case where the investor’s investment is only a fraction and not against the full value or price of the Property pay to the investor such market value of the Property in accordance with the fractional interest of the investor.

Is a TRUST INCOME PRODUCT available exclusively to Members

of trusts offered by Marathon Corporate Services Limited.

- Minimum Initial Investment: 1,000 USDT.

- Fund period: 1 year and it is renewable.

A minimum of 1,000 USDT will be deposited in the trust. Subsequently, the Trustee will place the investment amount with ABS as Custodian and Asset Manager to generate returns (monthly payment returns).

The Trustee will match the investment amount with a real estate of which its value is equivalent to the investment amount and hold the property on trust.

However, the investor has no rights to use the property nor be entitled to any benefits arising from the property during the fund period.

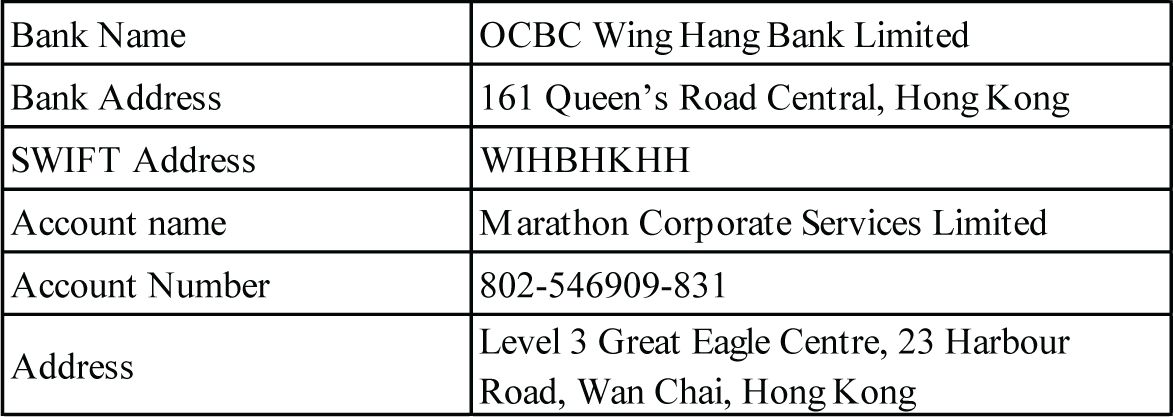

Process Flow

The Fund invested by investors shall mature upon completion of One (1) year period (“Fund Period”), unless extended.

Monthly Payment Returns:

In consideration of the placement of Fund by the Client, the Client shall be entitled to Monthly Payment Returns (if any), subject to and in accordance with the terms and conditions hereinafter contained.

The Monthly Payment Returns shall represent Thirty-Three Point Three Three Percent (33.33%) of the returns from the deployment of the Funds.

Notwithstanding anything to the contrary, the amount of Monthly Payment Returns shall be subject to the returns gained from the deployment of the Funds, market performance or condition, and ABS Secured DeFi Trust’s policies. The Client is fully aware of and agree to the same.

The Trustee shall have the power in relation to deployment of the Funds. In exercising its power, the Trustee will be guided by the advice of asset manager of ABS.

MCT Trust

The Company is licensed to provide trust (fiduciary) Services and company secretarial services such as company formation, registration, and ongoing filings under the Companies Ordinance on behalf of client companies.

Incorporated in the Fall of 2018 the Company was registered as a TCSP provider in February 2019.

The initial setup, including the establishment of bank accounts and initial trading accounts for payment systems and Block-Chain trading and commencement of operations, was completed by the end of March 2019.

MCT Business & Services

Monthly Payment Returns:

- Business & Administration

- Accounting & Bookkeeping

- Corporate Bank Account Opening

Corporate Secretary Services

- Company Formation & Business

- Establishment

- On-going

- Corporate Governance Solutions

Hong Kong Taxation

- Corporate Tax

- Individual Tax

- Tax Filing & Computation

- Audit Co-ordination

- De-registration & Liquidation

Business Process Review

- Compliance & Risk Control

- Corporate & Financial Due Diligence

- Business Exit Strategy

Trade Support

- Legalization, Certification & China Attestation

- IP Consultancy

- Others

- Mobile Crypto wallet

- Call and Fax Forwarding

Business in China

- Entry Strategies

- Entity Establishment Solution

- HR, Accounting & Tax

- Operation & Control

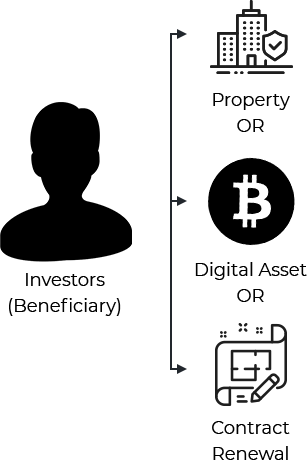

Options at the expiry of fund period

- The fund period shall be 1 year

At the end of fund period, investors have 3 options: - To redeem Digital Asset;

- To redeem Property; or

- To renew contract

- The beneficiary needs to instruct the Trustee to

make an option

Early termination before

the expiry of the fund period

Early Termination

The funds to be refunded to the Investors will subject to a deduction of 30% of the original investment amount. This is to cover costs incurred by ABS with respect to trust structure, attorney fees & stamp duty.

Deduction of 30% may not represent a loss

- Assuming that the investor invests 10,000 USDT, the profit is 5% every month, and after 6 months, the investor will have a profit of 30%

- Plus, the index rises, invest 10,000 USDT (index 100%) > index 150% = 15,000 USDT

18,000 USDT

– 3,000 USDT

= 15,000 USDT

+ 3,000 (Profit)

@ 30%

A TRUST INCOME PRODUCT OFFERED BY :

ABS GLOBAL REALTY SDN. BHD

Company No. : 201601042228 (1213170-M)

- Asset Custodian and Manager Registered address :

20-1, Premier Suite, Level 20, Menara One Mont Kiara,

Off Plaza Mont Kiara, Jalan Kiara, 50480, Kuala Lumpur

Phone = 603 – 62116486 Email realty@absgp.com

Trustee

Marathon Corporate Services Limited,

TCSP License Number: TC006228

- Head Office, Hong Kong

Room 5013, 50th Floor, Hopewell Centre, 183 Queen’s Road East, Wan Chai, Hong Kong Phone: +852 2566 2838 Member Services, Email ms@mcoserv.com

- KL Office

Marathon Fiduciary SDN Berhad #3 Jalan Industri Perdana, Desa Parkcity ,5220 Kuala Lumpur Direct: 6012 223 1059

Investment Risk

The Defi Staking markets are a relatively new and unproven market. Despite substantial investment growth in the market, there can be no certainty that the results achieved historically will be achieved in the future. The document contains forward-looking statements and projections. These projections represent the Company’s current best estimates and projections based on internally and externally sourced information. The core assumption, markets and projections are subject to change without warning, and as such, the Company cannot guarantee that the results projected will be achievable. Despite being secured, an investment in this program is not guaranteed. Investors must be aware of the potential for loss and should not invest funds they cannot afford to lose.

Due to the early stage of development, Crypto and Digital Asset Markets are exposed to regulatory and sovereign risks as various governments and regulators are still assessing the risks and developing ongoing regulatory approaches. Crypto and digital exchanges may be exposed to risks of fraudulent transactions, theft, and other loss of value due to criminal activity; Investors should be aware of the risks inherent in the markets and take steps to hedge, mitigate, and minimize such exposure. Other risks include Exchange hacks and Government push-back on the blockchain segment of the market. No guarantee of success. Regulatory risk. Cutting-edge tech is not always fully developed. Widespread adoption is required for long-term success. BlockChain supply may be fixed, unlike fiat currencies. Digital assets are volatile. There are many unknowns and a lack of regulatory control in the environment. The industry is in its infancy.

Despite Real Estate being a fundamental cornerstone of value in the economy, future returns are uncertain and are exposed to Force Majeure, Taxation and other market risks. There can be no guarantee that there will be a buyer available at any given time. Liquidity in real estate markets cannot be guaranteed.

Disclaimer

This fact sheet does not constitute an offer or solicitation with respect to the purchase or sale, investment, or subscription in any security and neither this fact sheet nor anything contained therein nor the information to which it refers shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. Applications will only be made by the Trustee for members of an MT Standard Trust offered exclusively by Marathon Corporate Services Limited. Prospective investors should be capable of evaluating the risks and merits associated with this investment and have sufficient resources to bear any losses. This investment is intended to be held by the investor for the full investment term. In the case of Force Majeure, whilst a secondary market exists, there is no guarantee of a purchaser. Liquidity may therefore be limited and should not be relied upon when choosing this investment. Investment involves risk to your capital. If you suffer a loss, you are not entitled to compensation from the Financial Services Compensation Scheme. The targeted return may be subject to variation. Investing in the program involves risks, including loss of capital and illiquidity and it should be done only as part of a diversified portfolio. To invest in the program, you must be a member of the MT Standard Trust established in Hong Kong with Marathon Corporate Services Limited, who as Trustees are a Professional Investor under the provisions of Hong Kong law. You should seek the advice of a professional investment adviser before investing, to ascertain and understand the full risks and terms associated with any investment, and any such investment must be made through Marathon Corporate Services, a licensed Trust Services firm. Any investment in the program are only available to, and will be engaged in with, members of an MT Standard Trust offered exclusively by Marathon Corporate Services Limited. You are strongly recommended to seek independent financial and legal advice before making an investment decision.

ABS GLOBAL REALTY SDN. BHD. (the company) does not undertake to update the information contained herein. The information provided is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. The Company and its affiliates may have made investments in some of the instruments discussed in this communication including cryptocurrencies and may in the future make additional investments, including undertaking Defi Staking and taking both long and short positions, in connection with such instruments without further notice. The information heretofore presented was prepared by the Company and outside assistance and is believed by the Company to be reliable and has been obtained from public and private sources believed to be reliable. The Company makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections heretofore presented constitute the current judgment of the Company and are subject to change without notice.

- Review the documentation,

- Complete the application including submitting government Photo ID and Proof of

residence. - Pay the establishment fee and Contribute the funds you intend to place in the Trust.

- Complete and submit the Investment Direction and Source of funds forms to the Trustee.